Real assets. Strong returns.

Want outstanding yields from a turnkey mortgage portfolio? Look no further.

Attractive products. Returns you'll love.

Invest with us to get access to high yields, a wide array of mortgage products, fractional diversification, and durations as short as 6 months.

Oh yeah, did we mention it's free to join? It's a win-win-win-win-win.

Institutional quality. Consumer access.

You benefit from a reliable, institutional-grade mortgage platform trusted by some of the largest credit funds in the world. Get access to sophistication and quality with none of the complexity or fees.

Build a diversified strategy in minutes.

Take control or lean back. You can pick individual loans or we can build you a portfolio instantly. Either way, it’s easy to start earning immediately with a collection of investments you can trust.

It's easy to invest...

1. Create An Account

Create your secure lending account and fund it with ease by connecting via ACH or wire transfer.

2. Choose Investments

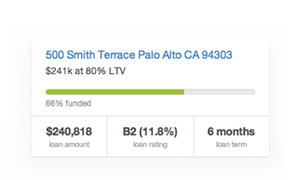

View our wide array of investment opportunities. Filter by any criteria. Assess the risk/reward profile.

3. Earn Returns

Receive a fractional interest in the loan. When the borrower makes a payment, you receive principal and interest.

Institutional Whole Loans

Join top banks, credit funds, private equity firms, family offices, and university endowments in partnering with us. Purchase whole loans from our institutional-grade loan production pipeline.

Schedule A Call →Consumer Fractional Notes

Get the same access, data, tools, and institutional-grade loans with the additional benefit of small commitments and fractional ownership enabled by our Platform Notes.

Signup Now →Common Questions

-

How do I invest on the platform?

The H.I.S. Loans and Real Estate Company investor platform makes it very easy to invest across the spectrum for both large institutions and individual retail investors. Institutions who want to invest should us to setup a time to talk. Individuals who want to invest can self-serve signup, see investment opportunities immediately, and invest within days.

-

Who is eligible to invest?

For now, only “accredited investors” can invest on the retail platform, which means you must meet certain minimum annual income or net worth thresholds. In addition, we may impose additional limitations on investor eligibility from time to time to comply with applicable laws and regulations or otherwise ensure investment suitability for potential investors. In certain circumstances, we may utilize third party accreditation services to verify that potential investors meet the requisite eligibility criteria and investors will need to be screened and verified before viewing potential investment opportunities.

On the institutional side, we currently work with many different classes of investors including hedge funds, private equity, mortgage desks, family offices, university endowments, and more.

-

What is the process like for an individual investor?

To apply to become an investor on the H.I.S. Loans and Real Estate Company platform, sign up as an investor to get started. We’ll guide you through our quick verification process to confirm your eligibility to invest on the platform. Then, you can connect your bank account, specify an amount, and pull funds directly to your secure platform account. Those funds will then be available for your investment almost always within 48 hours. While you’re waiting, you can browse investment opportunities. When the funds have arrived you can buy into loans with two clicks and specify the amount you want to invest. Then, you instantly receive a principal interest in a Platform Note and start earning cash flows that day. It’s that simple.

-

Can I pick my loans or are they assigned?

Institutions generally work with us on a forward flow basis that is passive and aligns with one of our core product specifications. Between the time the loan is assigned to the investor and when the trade is formally printed, investors can login to their investor dashboard and view their collateral.

Individuals are able to login, browse/search all investment opportunities, select ones that interest them, and specify the investment amount they wish to commit.

-

Are there minimum commitment amounts?

$10,000 is the minimum required capital to invest on H.I.S. Loans and Real Estate Company, but participations in individual notes can be as low as $1,000.

-

How long is my capital locked up?

Your capital will be deployed for the length of the loan term. It could be shorter if there is a prepayment by the borrower. It could be potentially longer should the loan have any issues of delinquency or default towards the end of the term. This is all conditioned on the payment behavior of the borrower for the underlying mortgage that then drives the repayment of the Platform Note.

-

What happens if a loan goes into default?

We will inform investors if any significant actions are taken on loans related to their investments, but we handle the process from end-to-end. That means the special servicing of working out the loan and successfully recovering principal and interest is all handled by the platform in addition to the regular every day activities. The entire process is truly turnkey for the investor.

-

Who can I talk to for support?

We're standing by. Please call 1-800.986.3871, Invest@tierralc.com, or live chat with us if you need help at any point.

Why invest with H.I.S. Loans and Real Estate Company?

Unbeatable Returns

We offer unique high yield products backed by reliable borrowers and rigorous credit standards.

Turnkey Access

You signup, fund your account, invest, and begin earning. That’s it. We do everything else.

Reliable Income

Steady investment gains come to you backed by the confidence of a diversified pool of notes.

Ready to build your mortgage portfolio?

Real assets. Strong returns. Invest today.

Start Investing Now →